In the end you "Can't buck the market". People always say that it is different this time, just before they jump off the bridge. It will crash within a year.Overvalued is subjective. Unless potential bankruptcy becomes a factor (see Nikola), stocks don't really have a true value. Sure, relative to historical norms, stocks are much more expensive relative to the economy than they used to be. But why are the old multiples more "real" than the new ones are?

Now that doesn't mean the markets won't crash. If we don't get a stimulus bill, deflationry pressures could bring markets down. Or if inflation becomes a problem sooner than expected, a rate hike could crash everything. But it's also possible the markets get pushed even higher. Nobody knows for sure.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

movdqa

Talk Tennis Guru

The pandemic is SARS Cov-2, the disease you catch is Covid-19.

I disagree with you. Those jobs would have gone anyway. Asset prices are far to high to sustain, the correction will be brutal and cause misery on an unprecedented scale. The pandemic is a side show.

Asset prices are set by supply and demand. If you constraint the supply, asset prices will rise. Why do you think that asset prices are far too high to sustain? Do you understand what a correction with time is?

You don't know that the jobs that we lost would have gone away without COVID.

If you believe that asset prices are too high, do you have a long-term leveraged short play?

I do put my money where my analysis is.

Topspin Shot

Legend

When a measure becomes a target...The usual metric is bond yields. But that metric has been obfuscated by Central Bank bond buying and the setting of very low or negative rates.

movdqa

Talk Tennis Guru

Large Specs had a the highest net short index futures position in over ten years. Probably the reason for the huge move on Friday.

Thre's currently a record high amount of shorts in China's markets at over $80 billion. This from $10 billion earlier in the year.

Stock prices ARE based on supply and demand. Chinese market is setup for one massive short squeeze.

Thre's currently a record high amount of shorts in China's markets at over $80 billion. This from $10 billion earlier in the year.

Stock prices ARE based on supply and demand. Chinese market is setup for one massive short squeeze.

I am fully in cash at present.Asset prices are set by supply and demand. If you constraint the supply, asset prices will rise. Why do you think that asset prices are far too high to sustain? Do you understand what a correction with time is?

You don't know that the jobs that we lost would have gone away without COVID.

If you believe that asset prices are too high, do you have a long-term leveraged short play?

I do put my money where my analysis is.

If it looks like negative interest rates, it will be gold and silver.

movdqa

Talk Tennis Guru

In the end you "Can't buck the market". People always say that it is different this time, just before they jump off the bridge. It will crash within a year.

"The market can remain irrational longer than you can remain solvent."

Topspin Shot

Legend

Out of curiosity, if you could hold only one asset class (stocks, bonds, cash, precious metals) over the next year, what would you choose? Next few years? Next decade-plus?"The market can remain irrational longer than you can remain solvent."

movdqa

Talk Tennis Guru

I am fully in cash at present.

If it looks like negative interest rates, it will be gold and silver.

The time to buy gold and silver was 2000.

Topspin Shot

Legend

Start with Kahn Academy or MIT open courses at the 101 level (fundamental courses are micro and macro) and if you're still interested, progress onward. Stay away from Internet bloggers, a few are good, but you don't have the tools yet to identify them. Also stay away from Austrian economists and MMTers.Just want a basic understanding really. Long term goal being to better understand the economies around the world and how the successful ones operate, if there are any. All I find are conspiracy theories lol.

movdqa

Talk Tennis Guru

Out of curiosity, if you could hold only one asset class (stocks, bonds, cash, precious metals) over the next year, what would you choose? Next few years? Next decade-plus?

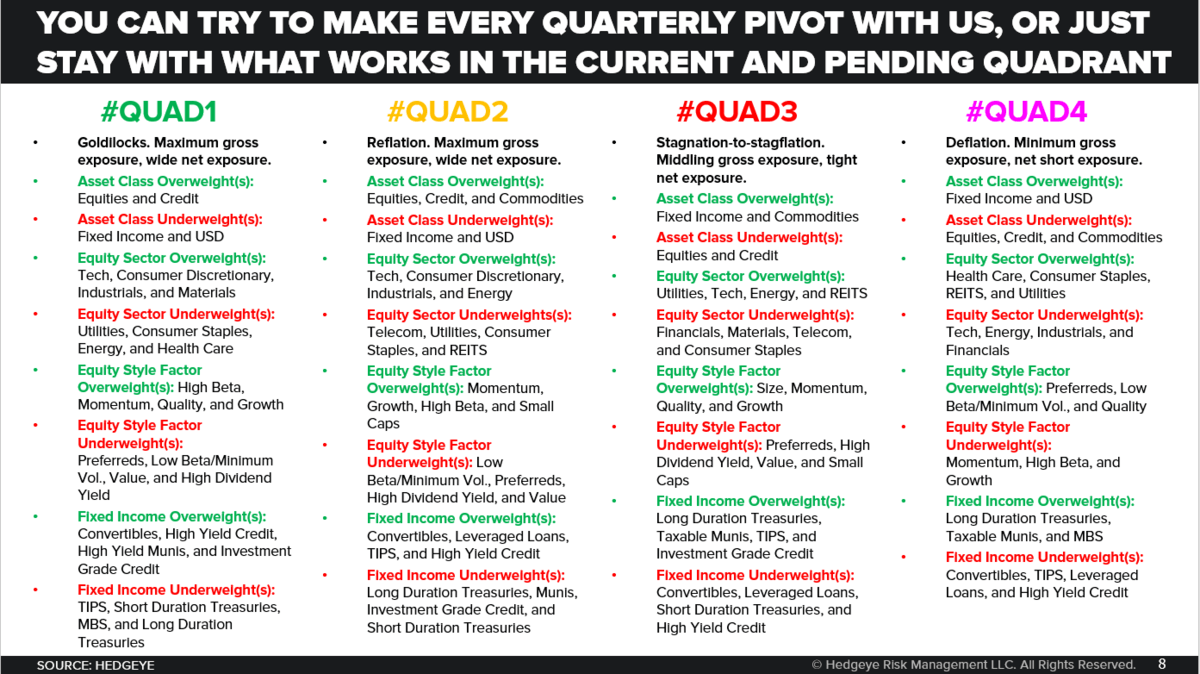

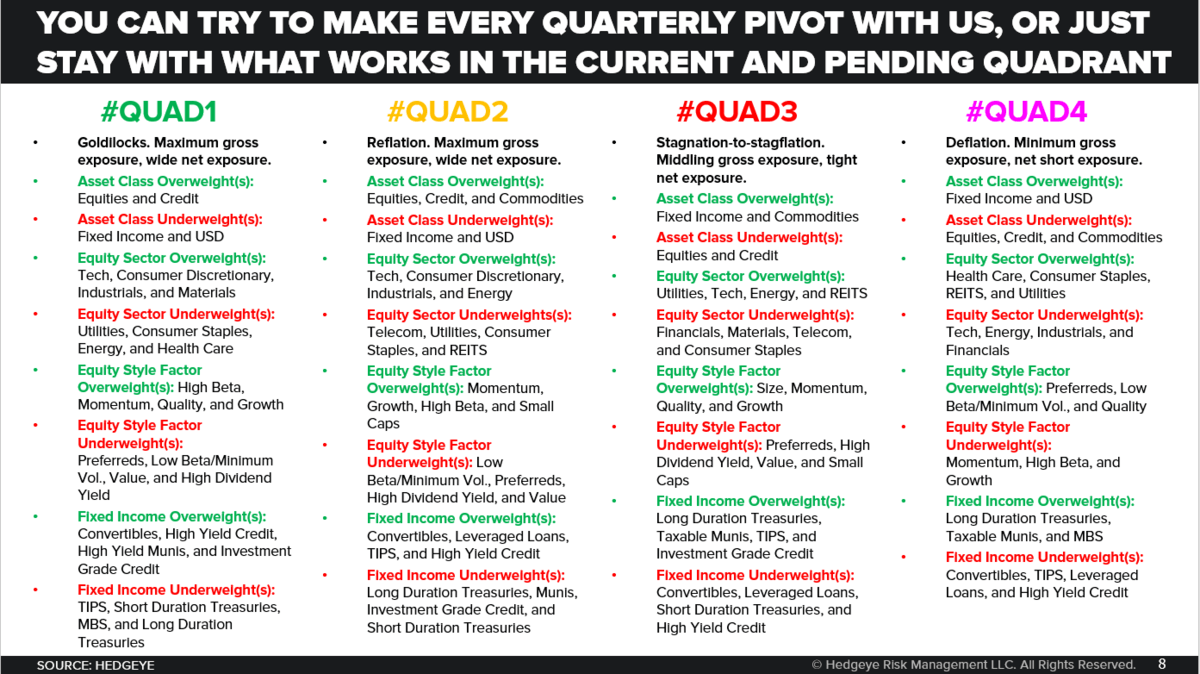

I'm a trader and believe that asset classes do well or poorly depending on economic models of Growth, Inflation and Policy. I currently follow the Hedgeye model.

The quads are defined below:

Last night I began reading an economics book on modern monetary theory. It's written by Warren Mosler.

he author has been called "one the brightest minds in finance" CNBC 2010

Amazon.com: Soft Currency Economics II (MMT - Modern Monetary Theory Book 1) eBook : Mosler, Warren: Kindle Store

Soft Currency Economics II (MMT - Modern Monetary Theory Book 1) - Kindle edition by Mosler, Warren. Download it once and read it on your Kindle device, PC, phones or tablets. Use features like bookmarks, note taking and highlighting while reading Soft Currency Economics II (MMT - Modern...

www.amazon.com

he author has been called "one the brightest minds in finance" CNBC 2010

- Soft Currency Economics is the little book that could logically, in both real and nominal terms, legitimately challenge many of the core held beliefs of the mainstream classical and neo-classical schools of economics.

- It is a corner stone publication for the new, widely popular fresh approach to economics that has come to be called Modern Monetary Theory (MMT).

- It explains with actual facts, not theory, and with non-technical language, the true operational realities of our monetary system (central banks and private banks).

- The author, a 40 year 'insider' in monetary operations, and a very successful fixed income hedge fund manager, wrote this book in 1993 after witnessing the markets drastically discount sovereign debt on the errant belief that market forces could force nations into default on debt payable in their own currency, and that austerity was the only solution.

- This was contrary to the author's understanding of what are called fiat currencies, where governments always have the ability to meet all obligations in a timely manner.

- As a result of this experience, the author took up the task of educating government officials on how the monetary system operated with the hope that with this understanding they would be free to ensure that the government acted for the public purpose and achieved their stated goals of full employment and price stability.

- Initially published in 1993, this book will utterly convince many readers that what they thought they knew about monetary policy is wrong.

- what is money;

- why debt monetization and the money multiplier are myths;

- how fiscal and monetary policy can be used effectuate full employment;

- deficits do not cause countries to default on their debt unless that is the decision

We all make choices, I will not make money, but neither will I loose any.The time to buy gold and silver was 2000.

movdqa

Talk Tennis Guru

Last night I began reading an economics book on modern monetary theory. It's written by Warren Mosler.

Amazon.com: Soft Currency Economics II (MMT - Modern Monetary Theory Book 1) eBook : Mosler, Warren: Kindle Store

Soft Currency Economics II (MMT - Modern Monetary Theory Book 1) - Kindle edition by Mosler, Warren. Download it once and read it on your Kindle device, PC, phones or tablets. Use features like bookmarks, note taking and highlighting while reading Soft Currency Economics II (MMT - Modern...www.amazon.com

he author has been called "one the brightest minds in finance" CNBC 2010

The book describes:

- Soft Currency Economics is the little book that could logically, in both real and nominal terms, legitimately challenge many of the core held beliefs of the mainstream classical and neo-classical schools of economics.

- It is a corner stone publication for the new, widely popular fresh approach to economics that has come to be called Modern Monetary Theory (MMT).

- It explains with actual facts, not theory, and with non-technical language, the true operational realities of our monetary system (central banks and private banks).

- The author, a 40 year 'insider' in monetary operations, and a very successful fixed income hedge fund manager, wrote this book in 1993 after witnessing the markets drastically discount sovereign debt on the errant belief that market forces could force nations into default on debt payable in their own currency, and that austerity was the only solution.

- This was contrary to the author's understanding of what are called fiat currencies, where governments always have the ability to meet all obligations in a timely manner.

- As a result of this experience, the author took up the task of educating government officials on how the monetary system operated with the hope that with this understanding they would be free to ensure that the government acted for the public purpose and achieved their stated goals of full employment and price stability.

- Initially published in 1993, this book will utterly convince many readers that what they thought they knew about monetary policy is wrong.

- what is money;

- why debt monetization and the money multiplier are myths;

- how fiscal and monetary policy can be used effectuate full employment;

- deficits do not cause countries to default on their debt unless that is the decision

I recommend this Camp Kotok discussion on MMT. Camp Kotok is a summer retreat for financial professionals, wealth managers and some Fed watchers. They had a fairly robust discussion on it with some fairly strong comments by Danielle Di-Martino Booth.

Topspin Shot

Legend

Which quadrant are we heading into though? I feel like that entirely depends on what politicians and central banks decide to do, and how do you predict that?I'm a trader and believe that asset classes do well or poorly depending on economic models of Growth, Inflation and Policy. I currently follow the Hedgeye model.

The quads are defined below:

Topspin Shot

Legend

Unless we start doing our transactions, paying our taxes, and denominating our debts in gold, you can absolutely lose money in it.We all make choices, I will not make money, but neither will I loose any.

I think that the danger is much larger for the US dollar. If the dollar is abandoned as the world currency it will be a junk currency and you will need a wheelbarrow of it to buy a packet of crisps.Unless we start doing our transactions, paying our taxes, and denominating our debts in gold, you can absolutely lose money in it.

movdqa

Talk Tennis Guru

Which quadrant are we heading into though? I feel like that entirely depends on what politicians and central banks decide to do, and how do you predict that?

We are in three heading into four.

They track a ton of data points and also track sectors to provide feedback on the current quarter. They also backrest their productions to improve their models. There are finance people that tweet out global high frequency data points on global markets so you have a feel.

F

FRV3

Guest

Why do you say this? That came up in a documentary I watched on bitcoin.Also stay away from Austrian economists.

r2473

G.O.A.T.

I hope you were in "Tech Stocks" for most of past decade (moving to cash of course at the exact right time during the downturns and then back in at the exact right time when the upturn started again).We all make choices, I will not make money, but neither will I loose any.

For this year, I hope you were in Tech right up until February 12th (I think) and then back in on April 3rd (I think), then back out on September 2nd (and still out now).

If so, please tell me when to get back in. And I mean the exact day. Thanks.

Of course if you were out for any of the time you should have been in, you didn't get in on the gains. Which means you sort of just have to stay "in". I mean, it was pretty hard to predict to pull out on Sept 2 close of day. Because up until that point, Tech stocks had gone up for basically 6 straight weeks or more, with pretty big gains. But if you were in on Sept 3, about 1/3rd of that was wiped out in a day. And then if you stayed in for the next 2 days (expecting a quick rebound), another 1/3rd was wiped out. But then if you jumped out then and missed September 9th, basically all of the losses from the 7th were reversed on the 9th, and you would have missed that.

And so on.......

Last edited:

What do you think? Not to make a career out of it. Just for your own education just so you know which investments might make sense or how to help struggling nations.

Just so you know, I am not an altruistic person. I would help struggling nations purely for my own ego, which is usually best done with money I believe. I think most developing nations struggle with sanitation? Anyone know how to help the cause?

No downside to learning something new

F

FRV3

Guest

Y'all would be impressed if you've seen what I've done with my investments hehe. It was all luck though. I think I made something around 47% return in 9 months in stocks when I used to be in the market. Then I went to cryptocurrency later on and turned around $4000 into $6000 in around a year I believe. This is less impressive because it started with my mom loaning me $2000 which I almost doubled and then I kind of remained stagnant as the remaining $2000 was me just putting money in little by little. I did lose around $1000 on one crypto when it went down, but then it went up 10x in one day, I got out when it came back down to 5x. Big mistake holding on, but it did move me to take out all of my crypto, and then the market went back down.

I think it's easy to double your money or whatever with small accounts. With larger accounts, there's a lot more nerves. And with really large accounts, it's more than just psychologically difficult.

I think it's easy to double your money or whatever with small accounts. With larger accounts, there's a lot more nerves. And with really large accounts, it's more than just psychologically difficult.

movdqa

Talk Tennis Guru

I hope you were in "Tech Stocks" for most of past decade (moving to cash of course at the exact right time during the downturns).

For this year, I hope you were in Tech right up until February 12th (I think) and then back in on April 3rd (I think), then back out on September 2nd (and still out now).

If so, please tell me when to get back in. And I mean the exact day. Thanks.

Of course if you were out for any of the time you should have been in, you didn't get in on the gains. Which means you sort of just have to stay "in". I mean, it was pretty hard to predict to pull out on Se[t 2 close of day. Because up until that point, Tech stocks had gone up for basically 6 straight weeks or more, with pretty big gains. But if you were in on Sept 3, about 1/3rd of that was wiped out in a day. And then if you stayed in for the next 2 days (expecting a quick rebound), another 1/3rd was wiped out.

Many professional traders use moving averages for entries and exits as opposed to targets. I picked up a new method a month ago using MA crossovers and some other technical indicators and wrote a book on it after interviewing the guy that invented it. I know another guy that uses Fractal Geometry, Fibonacci Retracements and Elliot Waves to come up with targets and I'm rather amazed at how he works price targets. So you have trend following systems and reversal systems.

An approach for the past 11 years would have been to just buy and hold the TQQQs in 2009. You'd be up enough to retire on. You would have needed a long enough moving average, though, to have kept you in through the corrections.

movdqa

Talk Tennis Guru

Y'all would be impressed if you've seen what I've done with my investments hehe. It was all luck though. I think I made something around 47% return in 9 months in stocks when I used to be in the market. Then I went to cryptocurrency later on and turned around $4000 into $6000 in around a year I believe. This is less impressive because it started with my mom loaning me $2000 which I almost doubled and then I kind of remained stagnant as the remaining $2000 was me just putting money in little by little. I did lose around $1000 on one crypto when it went down, but then it went up 10x in one day, I got out when it came back down to 5x. Big mistake holding on, but it did move me to take out all of my crypto, and then the market went back down.

I think it's easy to double your money or whatever with small accounts. With larger accounts, there's a lot more nerves. And with really large accounts, it's more than just psychologically difficult.

The problem with large accounts is that there has to be sufficient share liquidity in order to be able to get in and out.

I had lunch with a hedge fund manager back in 2004 or 2005 and he told me that we used the same methods to pick stocks, entries and exits. The difference is that he finds companies that he can't trade because the Average Daily Volume is too low. His taking a position would affect the stock price so it would be difficult to get in and out. He tossed me a few picks from time to time that were too small for him to play.

r2473

G.O.A.T.

Exactly. But of course, that's pretty tough to predict.An approach for the past 11 years would have been to just buy and hold the TQQQs in 2009. You'd be up enough to retire on. You would have needed a long enough moving average, though, to have kept you in through the corrections.

In my 401K, which has limited options, I've been in the closest equivalent to this for the past decade and I can't believe how well it's done.

In a 401K, it's pretty hard to move to cash for downturns, because it takes so long to get the trade done. And then you always figure that just when you move it, the next day will be the "recovery correction" and you'll miss out on that.

F

FRV3

Guest

Yeah, Warren Buffet said something similar. But I think even an account of $10000 is a lot more difficult than what I tend to work with, due to psychological barriers. I don't gamble, but when I believe in something, I'm not that scared to put a large portion of my money in because what is $1000 at the end of the day? Not much in the U.S. But if I lose $10000 that's like a years salary for me, as I work part time.The problem with large accounts is that there has to be sufficient share liquidity in order to be able to get in and out.

I had lunch with a hedge fund manager back in 2004 or 2005 and he told me that we used the same methods to pick stocks, entries and exits. The difference is that he finds companies that he can't trade because the Average Daily Volume is too low. His taking a position would affect the stock price so it would be difficult to get in and out. He tossed me a few picks from time to time that were too small for him to play.

movdqa

Talk Tennis Guru

Exactly. But of course, that's pretty tough to predict.

In my 401K, which has limited options, I've been in the closest equivalent to this for the past decade and I can't believe how well it's done.

In a 401K, it's pretty hard to move to cash for downturns, because it takes so long to get the trade done. And then you always figure that just when you move it, the next day will be the "recovery correction" and you'll miss out on that.

No prediction needed. The Moving Average is the stop.

My Fidelity 401k had an option called BrokerageLink. It allowed me to trade just about anything except for options. I'm now in a Fidelity IRA and added Limited Margin to the account yesterday.

movdqa

Talk Tennis Guru

Yeah, Warren Buffet said something similar. But I think even an account of $10000 is a lot more difficult than what I tend to work with, due to psychological barriers. I don't gamble, but when I believe in something, I'm not that scared to put a large portion of my money in because what is $1000 at the end of the day? Not much in the U.S. But if I lose $10000 that's like a years salary for me, as I work part time.

As you get older, preservation of capital is more important than potential gains. Drawdowns are difficult psychologically and generally take considerable trading efforts to recover from. Part of this is due to markets falling much faster than they rise.

Topspin Shot

Legend

They're a fringe group with a disdain for testing their theories with empirical analysis, and they often have outlandish ideas like going back on a gold standard. They have no shot in the economics profession because their work has too many holes in it, so they target libertarian circles who don't know enough economics to call out their BS.Why do you say this? That came up in a documentary I watched on bitcoin.

F

FRV3

Guest

I see. Thank you for that input.They're a fringe group with a disdain for testing their theories with empirical analysis, and they often have outlandish ideas like going back on a gold standard. They have no shot in the economics profession because their work has too many holes in it, so they target libertarian circles who don't know enough economics to call out their BS.

Topspin Shot

Legend

That's interesting, I figured you'd say 4 heading into 3. Or are you expecting minimal stimulus going forward?We are in three heading into four.

They track a ton of data points and also track sectors to provide feedback on the current quarter. They also backrest their productions to improve their models. There are finance people that tweet out global high frequency data points on global markets so you have a feel.

movdqa

Talk Tennis Guru

That's interesting, I figured you'd say 4 heading into 3. Or are you expecting minimal stimulus going forward?

3 is Growth Slowing, Inflation Accelerating. Fed can't do anything.

4 is Growth Slowing, Inflation Decelerating. Policy Response is more dovish.

Similar threads

- Replies

- 4

- Views

- 780

- Replies

- 19

- Views

- 3K